How to Improve Your Tax Business Marketing Strategy

Traditional methods like networking and referrals are still valuable. But to truly stand out, you need to incorporate modern digital strategies. For example, you can share insightful content on social media and create targeted content marketing campaigns.

However, there’s a versatile method tax businesses might not be using to its full potential—SMS marketing. When integrated thoughtfully into your overall marketing strategy, it can provide direct and personal communication with your clients.

In this guide, we will discover how combining different strategies can create a comprehensive and effective marketing plan for your tax business.

Get Started With Business Texting

View our pricing, and start your free trial with Textellent today!

What is Tax Business Marketing?

Tax business marketing promotes tax services to attract and keep clients. It uses a variety of strategies and activities to reach potential customers and make them aware of the services offered by tax professionals.

Effective marketing helps tax businesses in several ways:

- Good marketing brings in new customers.

- Consistent and informative marketing helps build a trustworthy reputation.

- Keeping clients engaged and satisfied encourages repeat business.

- More clients and better client relationships lead to higher earnings.

Developing a Marketing Strategy for Your Tax Business

Developing a marketing strategy for your tax business involves several structured steps. Each step is designed to help you understand your market, define your objectives, and implement tactics that effectively engage potential clients.

Here’s a step-by-step guide to developing a robust marketing strategy for your tax business:

- Define what you want to achieve with your marketing efforts. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Understand who needs your accounting services and segment them into groups based on characteristics like demographics, behaviors, and specific needs.

- Research your market to gather insights about your competitors, the latest industry trends, and the needs of your potential clients.

- Determine what makes your tax services unique compared to others in the market.

- Select the channels that will best reach your target audience, such as search engine optimization (SEO), digital marketing, and email marketing.

- Plan a variety of content types that address common tax concerns or changes in tax law.

- Allocate your marketing budget to maximize potential return on investment.

- Execute the marketing strategies and tactics you’ve planned.

5 Online Marketing Strategies for Tax Businesses

Online marketing is important for tax businesses looking to expand their reach and attract more clients. Here’s how to effectively harness the power of digital strategies:

1. Build a Professional Website

Your website is often the first impression potential clients will have of your tax preparation business. Make sure it is professional, easy to navigate, and informative.

Include essential elements like services offered, your team’s background, client testimonials, and clear contact information. A blog section with regular updates can also add value by sharing useful tax tips and industry news.

2. Search Engine Optimization (SEO)

Optimize your website to appear higher in search engine results. Start with keyword research to understand what terms your potential clients are searching for, such as “tax advice for small businesses” or “affordable tax services.”

Incorporate these keywords naturally into your website’s content, titles, and meta descriptions. To improve your site’s authority, focus on building quality backlinks from reputable sites.

Also, be sure to ask clients to leave you reviews on your chosen review sites. This is an important way to boost your SEO ranking, and always leave a review response, which helps further.

3. Social Media Marketing

Social media platforms are a great way to connect with potential clients. Choose platforms where your target audience is most active; for many tax businesses, this might be LinkedIn, Facebook, and Twitter.

You can share engaging content that offers real value, such as tax-saving tips, deadline reminders, and updates on tax laws. Engaging with users through comments and messages can also foster relationships and build trust.

4. Email Marketing

Email marketing allows you to keep in touch with your clients and prospects directly. Use it to send out newsletters, updates about changes in tax regulations, and personalized advice or reminders.

Segment your email list to tailor messages based on clients’ needs and ensure higher engagement rates.

5. Content Marketing

Create and share valuable content that addresses your clients’ tax concerns. This could include detailed blog posts, informative videos, and downloadable guides or checklists.

High-quality content not only helps in attracting new clients but also positions your accounting firm as a knowledgeable authority in the tax field.

6. Pay-Per-Click (PPC) Advertising

PPC can be an effective way to drive traffic to your website quickly. Use platforms like Google Ads to target specific keywords related to your services.

This method allows you to control the budget and target clients who are actively searching for tax-related services.

6 Offline Marketing Strategies for Tax Businesses

While online marketing is important for reaching a wider audience, offline marketing remains a powerful tool for tax businesses to establish a local presence and build strong relationships.

Here are effective offline marketing strategies that can complement your online efforts:

1. SMS Marketing and Servicing

SMS marketing for tax professionals is incredibly effective for inviting last year’s clients back for the new tax season and getting them to book an appointment a time to drop off their paperwork.

It is also effective at delivering timely information, such as appointment reminders or notifying them of missing paperwork and or even tax law updates. Its high open rates and quick response times make it an ideal communication tool for tax businesses, helping tax professionals get returns finished faster and more efficiently.

Through regular SMS communications, accounting firms can ensure they remain relevant to their clients throughout the year, not just during the peak tax season.

To boost client engagement, you can send regular updates, useful tax or scam avoidance tips, and timely reminders about deadlines. This will often translate to improved retention and an increase in client referrals.

2. Networking and Partnerships

Networking is key to expanding your client base and forging valuable partnerships. Collaborate with local businesses and attend events, industry conferences, and seminars.

Join local business groups and chambers of commerce to get your firm’s name out there and open doors to new collaborations.

3. Direct Mail Campaigns

Direct mail can be very effective. Send out materials like postcards, brochures, or letters that introduce your services.

Highlight what makes your business unique and include a clear call to action, like offering a free consultation or a discount for new clients.

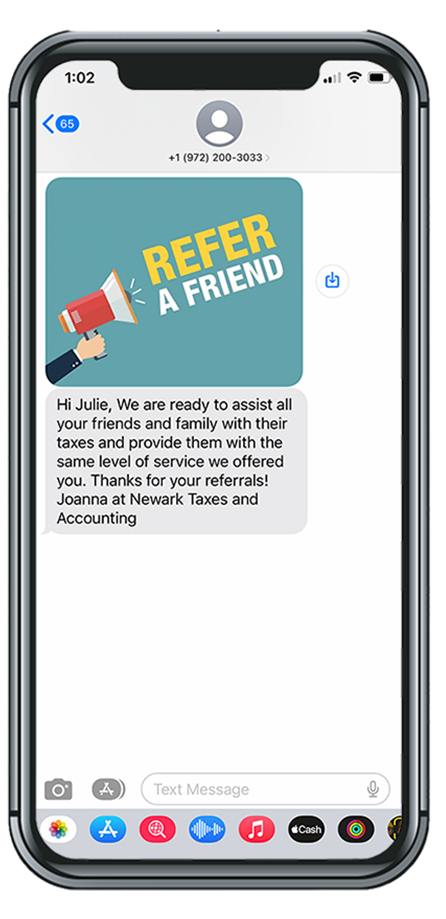

4. Referral Programs

Encourage your existing clients to refer new clients by offering incentives, such as discounts or free services. Word-of-mouth is a powerful marketing tool, especially in professional services like tax advisory, where trust and reliability are crucial.

Since it is often awkward to ask for referrals, asking via a text message once a client’s return is done can be an easy and effective way. Consider using this same approach when asking clients for reviews. You can easily send a text request with your review link included to make it easy for clients.

5. Speaking Engagements

Take opportunities to speak at local events or run workshops on tax-related topics. This helps establish your authority and puts you in front of potential clients.

Offer practical, actionable advice that attendees can apply, making your firm the go-to expert when they need tax services.

The Power of SMS Marketing in the Tax Industry

SMS marketing has become crucial for tax professionals, offering a direct and immediate way to communicate essential information to clients.

Because text messages typically have higher open rates than emails, important notifications such as tax updates are promptly read.

Clients value the convenience of SMS, which allows them to receive timely updates without needing to check emails or handle phone calls. This method integrates smoothly into their daily routines and improves their experience with your tax preparation services.

SMS marketing is also cost-effective, which provides a significant return through high engagement and improved client retention.

Additionally, many SMS solutions like Textellent can integrate seamlessly with tax software to automate messages triggered by specific client actions or deadlines.

How to Automate Your Tax Marketing with Textellent

Missed appointments can disrupt your schedule and delay important tax work. With Textellent, you can set up automated SMS reminders that prompt your tax clients about their upcoming appointments.

Textellent seamlessly integrates with most tax preparation software. This integration allows you to automate communication based on specific triggers, such as completing a tax return or an upcoming deadline.

Once set up, these triggers will send automatic notifications to your clients to keep them informed without manual intervention.

Textellent provides pricing options designed especially for tax professionals. With their unique calculator, you can determine costs tailored to your specific requirements, ensuring you receive the best value for your investment.

Your subscription includes several key automated text campaigns :

- Inviting previous clients to return based on their past interactions

- Sending reminders about incomplete or missing paperwork

- Reaching out to clients who have not returned

- Requesting referrals and reviews in a friendly and automatic way

- Delivering holiday and birthday greetings all year long

Additionally, Textellent’s service integrates effortlessly with your existing tax software to text-enable your office phone number. It lets you send targeted, automatic text messages based on your client’s current status and enables two-way texting without the need to use your mobile number.

Boost Your Tax Season Marketing with Smart Texting Solutions

Are you looking to boost your tax services this season? Textellent offers intelligent, automated communication that delivers impactful results. With personalized, automated messages, you can reconnect with former clients, simplify your document reminders, and create client loyalty.

Discover how easy it is to upgrade your client interactions and drive growth with our smart, automated solutions. Sign up for a free trial or request a demo consultation today.

FAQs About Tax Business Marketing

What legal requirements must tax professionals consider when sending SMS messages?

Ensure all messages comply with applicable laws, such as the TCPA in the U.S., including obtaining explicit consent to receive SMS marketing-type messages (not needed for customer service issues) and providing an easy opt-out mechanism.

Are there specific marketing strategies for corporate versus individual tax clients?

Yes, corporate clients often require content that addresses their business needs, such as large-scale tax planning. However, individual clients may be more responsive to personal finance tips and simpler tax-saving strategies.

How do loyalty programs work for tax services, and are they effective?

Loyalty programs for tax services can include discounts for repeat customers, referral bonuses, or value-added services at a reduced cost. These programs help retain existing clients and can be effective in increasing client satisfaction and loyalty.