How SMS Fits Into Your Tax Season Marketing Plan

Every year, millions of individuals and businesses file their taxes, receive refunds, or look for help from professionals.

This makes tax season a period filled with decisions, deadlines, and money movement. It also creates a chance for accountants, tax preparers, financial advisors, and retailers to reach clients with targeted offers and helpful information.

Because of these trends, companies that prepare early for tax season campaigns can gain long-term clients, retain clients, and stand apart from the competition with smarter marketing efforts.

In this article, we’ll walk through everything you need to know about tax season marketing. We’ll look at the best strategies and see how incorporating SMS marketing makes client outreach faster.

Why Clients Spend Differently During Tax Season

For tax professionals, tax season is the main time of the year when clients are actively looking for tax preparation services. When spending rises, it’s also a period for retailers and financial service providers to attract customers with special offers and promotions.

The success of your tax preparation business depends on knowing how people think and act during this time of year. You need to study common patterns so you can design campaigns that match what customers already want to do.

Tax refunds drive spending surges. According to IRS reports, the average refund through late March 2025 was about $3,170, with direct deposit refunds averaging $3,236.

Many individuals view this money as bonus income rather than part of their regular budget. That mindset often leads to higher spending on items like electronics, cars, home upgrades, and travel.

During tax season, there is also a flood of ads from firms, financial apps, and local preparers. If your tax business is not reaching out with its own campaigns, competitors will quickly fill the gap for your tax clients.

Tax season also brings unique emotional triggers. Many potential clients feel relief once they file, and that sense of closure encourages spending. Others experience a feeling of urgency, especially those who wait until the April deadlines.

Why SMS Appeals to Tax Season Clients

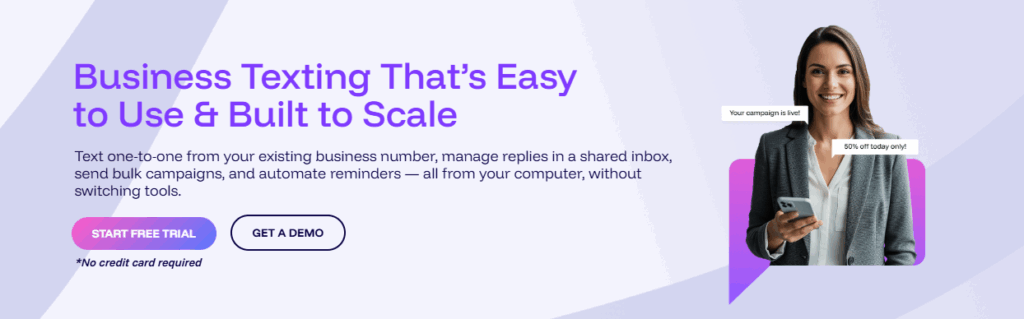

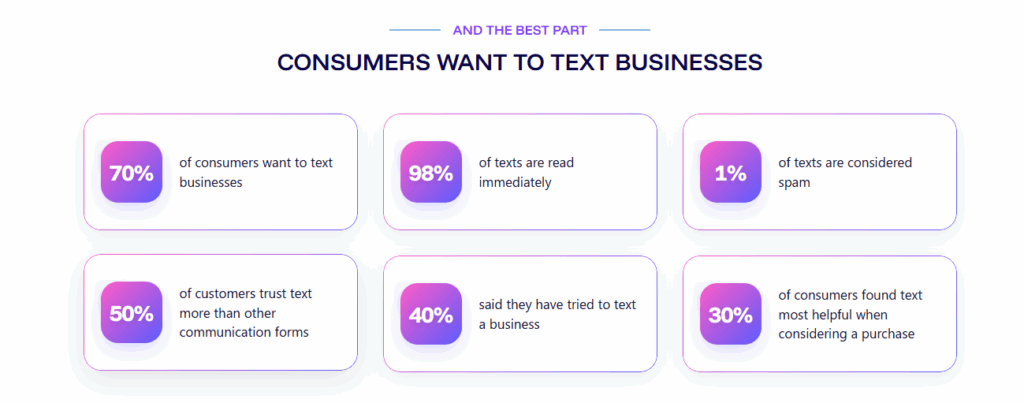

Clients don’t want long phone calls or endless email chains. They want quick answers and simple reminders. SMS is one of the best tax advertising ideas you can use to stand out.

A short message reminding someone of an appointment, confirming that paperwork is complete, or notifying them that their refund is ready can save hours of back-and-forth communication.

Business texting also reduces missed appointments, which can hurt cash flow during the busiest months. Instead of leaving voicemails that may never be returned, an automated text reminder gives clients a prompt they’re far more likely to read and act on.

Ready to simplify your tax season communications? Sign up for a free trial or request a demo consultation with Textellent today!

When to Start Tax Season Marketing

Many firms focus only on the weeks before the April deadline, but planning earlier creates better results.

The IRS begins accepting returns in late January, which means your clients are already thinking about filing long before April. If you wait until the last minute, you risk losing clients to firms that reached out weeks earlier.

Pre-Season Campaigns (November–January)

When you launch pre-season campaigns, it can help you reconnect with past clients before they start shopping around.

This is the time to remind them through direct mail campaigns, blog posts, or checklists about new tax laws. Sharing useful resources builds trust and shows that you’re aware of current tax regulations.

If you start early with financial planning, you’re showing that you are proactive and reliable, which are two qualities valued by clients and accounting professionals. This approach is powerful for local businesses trying to stand out.

Peak Season Campaigns (February–April)

By February, many taxpayers are ready to file, especially those expecting refunds. This is the peak moment for outreach and follow-ups.

During this period, you can push special offers or refund-related promotions. You can also run ads that address common tax concerns or promote your tax practice to highlight tax benefits.

The main goal here is to attract potential clients while staying ahead of firms that might be competing for the same local clients.

Consistency across ads, email marketing, and SMS can also remind existing customers to return, while helping you convert satisfied clients into repeat business.

Late-Season Campaigns (April)

April is when procrastinators finally take action. Last-minute filers are often stressed and looking for someone who can help quickly.

Flexible scheduling and SMS reminders are key here. You can text: “Still need to file? We have appointments available this week!” to capture people still struggling with tax filing.

Effective Tax Season Marketing Strategies

Clients have choices, and your competitors are already targeting them. The strategies below will help you stand out, keep clients coming back, and attract more clients during this busy season.

Targeted SMS Marketing

Your clients are already glued to their phones, which means your appointment reminders, updates, and offers will reach them quickly.

For a time-sensitive period like when tax season approaches, this makes SMS one of the most effective marketing methods to keep clients engaged and returning.

Here are some practical ways you can put SMS to work in your campaigns:

- Appointment reminders: Reduce no-shows with automatic reminders that go out the day before and the morning of each appointment

- Paperwork requests: Send a text asking for missing tax documents, and let clients reply with a photo

- Status updates: Notify clients when their return is filed or when their refund is ready

- Review requests: Automatically text clients after their appointment, asking for an online review

- Referral campaigns: Send out bulk SMS offering rewards when clients refer friends or family

- Promotional messages: Highlight seasonal offers like early-bird specials or refund-related discounts

While many platforms offer general texting, Textellent is built with the tax services industry in mind. It works with the software you already use and comes with pre-built SMS campaigns designed specifically for tax season.

Ready to use texting to grow your practice this season? Sign up for a free trial or request a demo consultation with Textellent today!

Incorporate Promotions and Discounts

Tax season is the one time of year when your target audience is already focused on money, deadlines, and refunds. This makes promotions and discounts more persuasive.

Here are some proven ways to grab attention during tax season:

- Early-filer discounts: Offer a small price cut for clients who book in January or February to spread out work instead of getting swamped in April

- Bundle offers: Package tax preparation with other accounting services, such as bookkeeping or tax planning

- Referral rewards: Give existing clients a discount when they send you a new customer

- Refund-based promotions: If you’re in retail, position sales around refund spending with messages like “Spend part of your refund here and save 10%”

Even small discounts go a long way because clients feel like they’re getting extra value during a season already tied to money management.

Create Educational Content

Tax season is stressful. Clients are worried about missing forms, new rules, or how to handle deductions.

When you publish valuable content that explains these things in plain language, you remove confusion. Articles, guides, and checklists also generate positive reviews when people see your firm as a trusted resource.

It also helps small business owners and individuals searching online find you first, especially when your content is optimized with keyword research.

Strategic local SEO technique improves your local search results and raises visibility in search engine results. You can build trust and establish your firm as an online authority for practical financial guidance.

Even the best content won’t help if people don’t see it. A short text with a link can bring more eyes to your content. For example:

- “Need help with deductions this year? Read our quick guide here: [link]”

- “Filing soon? Here’s a checklist of documents to bring: [link]”

Textellent helps you schedule educational messages in advance, send them to specific client groups, and personalize them by name. That way, your content educates while helping you provide valuable insights and drive website traffic.

Run Social Media Campaigns

People spend hours each day scrolling through social media platforms like Facebook, Instagram, LinkedIn, and TikTok. Utilizing social media where your target audience already spends time can help you grab attention and remind them that it’s time to file.

During tax season, your clients are searching for help. Many look up tax-related guides or success stories and rely on Google reviews before making a choice. Digital marketing on these channels, from tax tips to deadline countdowns, keeps your firm visible.

Likes and comments are great, but they don’t always turn into bookings. When someone sees your post and wants more info, you can give them a quick way to reach you instantly through text message advertising.

Textellent lets you integrate client portals or text-in keywords into your campaigns.

Partner and Referral Programs

People are more likely to trust a service recommended by friends, family, or a trusted partner than by any ad.

This is why getting more referrals can have such a big impact on your revenue during tax season. It’s also a low-cost way to win more clients while strengthening relationships with the ones you already have.

A satisfied customer talking about your service is more convincing than any paid campaign. Referral clients also tend to stay longer and spend more because they already come in with trust built.

You can use referrals to expand your reach this season by offering discounts, collaborating with local newspapers, or working with other referral networks to share opportunities back and forth.

This type of trust-building is one of the most actionable strategies you can put in place.

Spend Less Time Calling, More Time Filing—Start Texting With Textellent!

Clients expect convenient communication, and nothing delivers that better than SMS. Rather than hoping clients check their email or answer your calls, you can reach them instantly with personalized texts.

With Textellent, you don’t have to send each message by hand. The platform automates personalized reminders based on client behavior, such as when they typically file.

Using the right tools helps you keep every touch point running on autopilot while still looking professional.

This season, give yourself the advantage. Use Textellent to meet client expectations, boost referrals, and increase repeat business without adding more work to your plate.

View all product services here.

Sign up for a free trial or request a demo consultation with Textellent today!

FAQs About Tax Season Marketing

What is the tax-selling season?

The tax-selling season refers to the period when tax-related services and promotions are in highest demand, usually from late January through mid-April. This is when most people are filing their returns and receiving refunds.

For an accounting firm, this is also the best time to capture new clients and stand out in a competitive market.

How do I advertise as a tax preparer?

If you’re a tax preparer, the key to advertising is being visible where your clients are looking. Here are some practical steps you can take:

- Make sure your Google Business Profile is set up and create content built around relevant keywords

- Share helpful tax tips and reminders on platforms like Facebook and Instagram

- Run Google or Facebook ads targeted to your local area

- Use SMS automation tools to send reminders, promote early-filer discounts, or share your referral program

What does tax season mean?

Tax season is the yearly period when individuals and businesses prepare and file their tax returns. In the U.S., it starts in late January when the IRS begins accepting returns and ends on April 15 (unless extended).

This period is critical in the tax industry as it’s when demand spikes, current clients expect faster responses, and client needs for accurate filing are at their highest.

How much should a tax preparer charge per hour?

Rates for tax preparers vary based on experience, location, and complexity of the return. On average in the U.S.:

- Hourly rate: $100–$200 per hour

- Simple returns (Form 1040 only): Around $220 total

- Itemized returns (Schedule A): Around $323 total

- Business returns (Schedule C): $400 or more

If you’re just starting, you may set a lower rate to attract new tax clients, but don’t undervalue your time. Experienced professionals or firms that also provide powerful marketing tools like mobile-friendly client portals, client reviews, and bookkeeping add-ons can justify higher fees.