9 Best Marketing Methods For Tax Professionals

Marketing for tax professionals requires a smart mix of traditional methods and modern strategies to make an impact. Meeting clients where they are most active and delivering value in meaningful ways is the key to building trust and growing your practice.

While classic methods like networking and referrals remain valuable, digital strategies can extend your reach and deepen relationships.

Methods like networking and referrals still work, but pairing them with digital strategies can take your efforts further.

Using social media to share valuable tax tips, collecting positive client reviews, and creating informative content are all effective ways to attract and retain clients.

However, one of the most direct and effective methods is SMS marketing. This strategy delivers timely, personalized communication directly to clients’ phones.

It can be used for appointment reminders, quick tax tips, or updates on tax laws for immediate and personal interaction.

In this article, we’ll explore the best marketing strategies for tax professionals and show you how to reach your clients and drive results.

When to Create a Marketing Plan for Your Tax Business

Creating a marketing plan at the right time is essential for the success of your tax business. Ideally, you should develop a marketing plan before launching your business or during the early stages.

However, there are specific moments when it is especially beneficial to revisit or create a marketing plan:

- Before-tax season: This is the most critical time to ramp up your marketing efforts. Many people look for a tax professional just before the tax season starts.

- During off-peak periods: Use slower times to plan and execute marketing strategies that will keep your business top-of-mind year-round.

- After major tax law changes: Major changes in tax laws can drive new tax clients to seek expert advice. Ensure your marketing highlights your expertise in these areas.

Steps to Develop a Marketing Plan for Tax Professionals

Creating a marketing plan for your tax preparation business doesn’t have to be complicated. Let’s break it down step by step.

Define Your Marketing Objectives

First, figure out what you want to achieve with your marketing efforts. Are you looking to attract more clients or boost your brand awareness? You must set clear, measurable goals to help guide your strategies and evaluate your success.

For example, you might aim to gain 50 new clients this tax season or increase website traffic by 20% in the next six months. Clear goals will give you a target to work towards and help you measure your success.

Conduct Market Research

Next, learn about your target audience—identify who they are and understand their needs and challenges. This knowledge will allow you to customize your marketing messages to connect with them effectively.

Additionally, analyze your competitors. Look at what they’re doing right and where there’s room for improvement. It can help you spot opportunities to stand out and offer something unique.

Set a Budget

Once you have a clear understanding of your objectives and market, set a budget for your marketing activities.

Decide how much you’re willing to spend, and make sure your budget covers various marketing activities like online ads, direct mail, social media marketing, and content creation. It’s essential to balance your budget between different channels to see what works best for your business.

Develop Your Unique Selling Proposition (USP)

Develop your Unique Selling Proposition by highlighting what makes your tax preparation services unique. Emphasize your expertise, personalized service, or innovative solutions.

Your USP should be clear and compelling, setting you apart from the competition.

Select Your Marketing Channels

Choose your marketing channels based on where your audience is most active. This could include social media platforms, email marketing, SMS marketing, content marketing, and more.

You need to focus your efforts on the channels that will give you the best return on investment.

Create a Content Calendar

You have to create a content calendar to plan your digital marketing activities throughout the year. Then, schedule blog posts, social media updates, emails, and other marketing campaigns in advance.

A well-structured content calendar ensures consistency with your marketing efforts and allows you to plan around key dates and events in the tax industry.

Implement and Monitor

Finally, implement and monitor your marketing plan. You can launch your marketing activities and use analytics to track performance. Regularly review your metrics to see what’s working and what’s not.

Also, be prepared to make adjustments as needed to optimize your strategy and achieve your goals.

9 Marketing Strategies for Tax Professionals

Effective marketing is essential for tax preparers to attract new clients, retain existing customers, and grow their practice. Here are nine strategies to help you grow your business.

1. Building a Professional Website

Your website is the first impression many clients will have of your business. Your site should be:

- Informative, easy to navigate, and optimized for search engines

- The homepage clearly outlines your accounting services and benefits

- The “About” page should tell your story and highlight your expertise

- Add detailed service pages explaining what you offer

- Regularly update the site to provide tax tips, testimonials, and industry news

- Make your contact information easily accessible

SEO is also important for your website. You can naturally use relevant keywords like “tax preparation” and “tax consulting” throughout your site.

Make sure to write compelling meta descriptions and title tags to attract clicks from search engines and make your website as mobile-friendly as possible.

2. Taking Advantage of Social Media

Social media platforms are effective tools for engaging with potential clients and showcasing your expertise. LinkedIn, Facebook, and Twitter are especially useful for tax preparers.

Post valuable content regularly, such as tax tips, updates on tax laws, and insights into your services. Engaging with your followers is key—respond promptly to comments and messages to build relationships and trust.

You can share a weekly tax tip leading up to tax season on Facebook or a detailed article on LinkedIn about recent tax law changes. These platforms are also great for running tax preparation ads to reach specific demographics likely to need your services.

3. Using Online Reviews and Testimonials

Positive reviews and testimonials are essential for building trust and credibility.

You can encourage your clients to leave reviews on your Google My Business and Yelp platforms. It’s also ideal to respond to all reviews, whether they’re positive or negative.

This shows potential clients that you value feedback and are committed to excellent service.

You could send a follow-up email or text after completing a client’s taxes, thanking them for their business. You may also ask them to leave a review at the link provided if they were satisfied with your service.

Responding to reviews, especially negative ones, professionally and promptly can turn a bad experience into a positive one.

4. Blogging for Tax Professionals

Blogging is an excellent way to attract potential clients by sharing your expertise. Write about topics that address common tax questions, recent changes in tax laws, and practical tax planning tips. You can also use relevant keywords and internal links to boost your SEO.

It’s also great to share your blog posts on social media and include them in your email newsletters.

A post titled “Top 10 Tax Deductions for Small Business Owners” could attract a lot of attention. Regularly updated content keeps your site fresh and positions you as an authority in your field.

5. Creating Informative Videos and Webinars

Videos and webinars are engaging ways to share your knowledge. Plan your content to address your audience’s interests, such as tax-saving strategies or how to file taxes.

You can also promote your videos on your website and social media platforms.

You might create a webinar titled “Tax Preparation Marketing Tips for 2024” and invite your clients and social media followers to attend. Videos simply explaining complex tax topics can also be a big hit.

6. Networking and Partnerships

Networking with other professionals and forming partnerships can grow your business. Join professional associations and attend their events to meet other tax professionals and potential clients.

Consider partnering with related tax preparation businesses, such as financial advisors and accountants. For example, you could collaborate on a seminar about financial planning and tax strategies, benefiting both parties and expanding your client base.

7. Optimizing for Featured Snippets

Featured snippets are concise answers that appear at the top of Google search results, often referred to as “position zero.”

To optimize for them, structure your content with clear headers and provide direct answers to common tax questions.

8. Email Marketing

Email marketing is a direct way to communicate with your clients and potential clients. To encourage sign-ups, build an email list by offering a free resource, like a tax checklist or an ebook on tax planning.

Segment your list to send targeted emails to different groups within your audience.

9. Text Message Marketing

SMS marketing is important for tax professionals who need to remind clients to make appointments to get their returns started each new tax season.

It is also key to communicate time-sensitive information, like appointment reminders, outstanding paperwork needed, deadlines, and tax law updates.

SMS has gained popularity due to its high open rates and quick response times. It also helps tax preparers communicate with clients more efficiently and, therefore, complete returns more quickly.

Regular SMS communication keeps your clients engaged with your services throughout the year, not just during tax season.

Sending periodic updates, tax tips, and reminders keeps your accounting firm top-of-mind, leading to increased client retention and referrals.

For example, sending a simple holiday greeting to your clients can get them thinking about your firm as tax season approaches.

Additionally, clients appreciate the convenience of SMS communication. It’s quick and easy, and they don’t need to log into email accounts or apps.

The Role of SMS in Modern Marketing Strategies

Tax and accounting professionals must adopt modern strategies to stay competitive and effectively communicate with clients.

Using text messaging in your tax business marketing and client management strategies creates a more efficient, client-centered practice.

Clients often prefer quick and convenient updates. Text messaging allows you to send reminders, updates, and important information directly to their phones. This can be especially useful during tax season when clients are eager to receive timely information about their filings.

Moreover, text messages have higher open rates compared to emails, ensuring your messages are read promptly. The immediacy and personal nature of texting make it an effective way to get your message across quickly.

How Tax Professionals Can Use SMS for Marketing Strategies

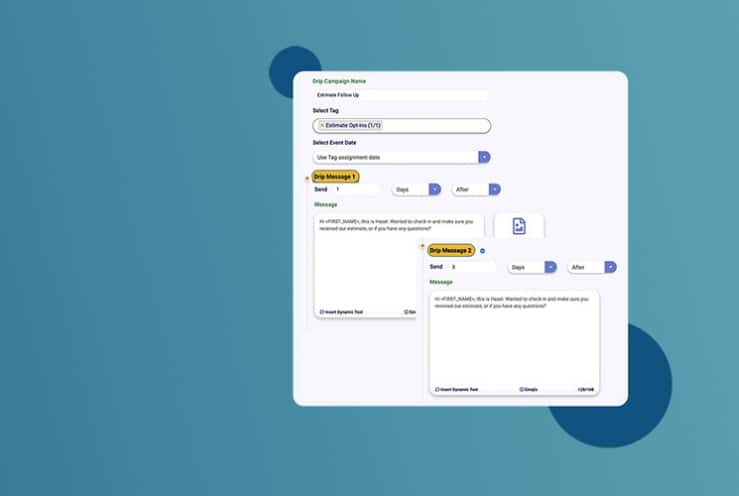

Tax professionals can improve their marketing strategies with the right SMS platform like Textellent.

Textellent automates the process of sending personalized messages at key touch points. This includes early outreach to clients depending on when they filed taxes the year before, setting appointments with reminders, missing paperwork, tax filing updates, and seasonal greetings.

You can set up automated reminders for clients to schedule their tax appointments and even send them updates when their filings are completed. These automated messages save you time and ensure that your clients receive timely and relevant information.

Textellent offers pricing specifically tailored for tax professionals. You can use their special calculator to estimate costs based on your specific needs to ensure you get the most value from your subscription.

What’s Included with Your Subscription:

- Inviting clients back based on their previous interactions

- Reminding clients about missing paperwork

- Re-engaging clients who haven’t returned

- Automatically requesting referrals and reviews in a friendly manner

- Sending holiday and birthday greetings throughout the year

- Sharing tax tips and promoting additional tax services

Moreover, this texting solution integrates with your existing tax software to text-enable your existing office phone number. This allows you to send automatic, relevant text messages based on your clients’ status and engage in two-way texting without using your personal cell number.

Get Ahead This Tax Season with Automated Texting Solutions

Ready to take your tax practice to the next level? With Textellent, you can make smart communication that brings results. Re-engage past clients, simplify your paperwork reminders, and build a culture of loyalty through personalized, automated interactions.

Don’t miss the opportunity to transform your client-facing communication. See how easy it is to grow your business with the right tools.

Sign up for a free trial or request a demo consultation today.

FAQs About Marketing for Tax Professionals

What are some unique challenges in marketing for tax professionals, and how can they be addressed?

One unique challenge is communicating complex tax information in a way that is understandable. Tax professionals can address this by using clear, jargon-free language in their marketing materials and focusing on solving common client problems.

Another challenge is client retention, which can be improved by offering consistent value through informative content and regular updates.

How do tax professionals ensure their marketing messages stand out?

During the busy tax season, marketing messages must be concise, clear, and relevant to client needs. Using bold calls to action, highlighting urgent tax deadlines, and providing clear solutions to common tax season problems can help messages stand out.

Additionally, using SMS marketing for timely reminders can ensure that communications are noticed.

How can data analytics improve marketing strategies for tax professionals?

Data analytics can provide insights into client behaviors, preferences, and engagement patterns. Analyzing this data can tailor tax professionals’ marketing strategies to meet client needs better and refine their services for increased client satisfaction.