Benefits of SMS During Tax Season (Why Clients Respond Better)

Accounting firms often struggle with late paperwork, missed appointments, and slow responses. Emails go unread, and some clients wait until the last minute to send important documents.

These delays make tax season more stressful than it needs to be, which leaves you rushing to meet deadlines with little time to spare.

SMS messaging makes communication easier and faster. You can send a quick reminder to prompt clients to send their W-2, confirm an appointment, or check their filing status without needing a long phone call.

In this article, we will explore the benefits of SMS during tax season and why clients respond better to text messages than other forms of communication. We’ll also look at how using an automated messaging platform can save time and create a better experience for your firm and clients.

Common Tax Season Frustrations (and How SMS Helps)

As a tax professional, you know how hectic tax season can be. Missed appointments, last-minute filings, and endless phone calls take up valuable time and make it difficult to focus on your actual work.

Text message marketing is a faster, more reliable way to communicate with clients. Unlike emails that go unread or phone calls that clients may ignore, text messages have a 98% open rate and are typically read within 90 seconds.

Here’s how text messaging can solve some of the biggest tax season challenges you face.

Last-Minute Tax Rush

Every year, many clients wait until the last moment to file their taxes. As the deadline approaches, your office becomes flooded with calls, urgent document requests, and emergency filings. The workload becomes unmanageable and leaves little room for careful tax preparation.

Sending SMS reminders early in the season can encourage clients to schedule their tax appointments before the rush.

A simple message about filing deadlines sent in January or February can prevent a last-minute scramble in April. Clients are much more likely to respond to a quick text than a tax-related email they may overlook for days.

Missed Appointments

No-shows can be a major issue, especially when tax season is at its peak. Every missed appointment means wasted time and lost revenue. Clients often forget about their scheduled meetings, even if they are confirmed weeks earlier.

A text reminder the day before or the morning of the appointment ensures they don’t forget. If they need to reschedule, they can respond immediately and give you time to adjust your calendar.

Unanswered Tax Questions

Clients often have quick questions about deductions, extensions, or payment options. Instead of responding to dozens of phone calls and emails, SMS allows you to handle these inquiries better.

If a client asks about a tax extension or refund timeline, a short text response can save time for both of you. For more complex questions, SMS can be used to schedule a consultation.

Therefore, communication flows consistently without slowing down your day with lengthy back-and-forth calls.

Refund Status Confusion

Clients typically reach out to ask about their tax refund status. These repeated calls and emails take up a lot of time, even though the information is usually available online.

Instead of answering the same question multiple times, you can send automated SMS updates when returns are filed or refunds are processed. This way, clients stay informed without needing to contact you directly.

Request Missing Documents

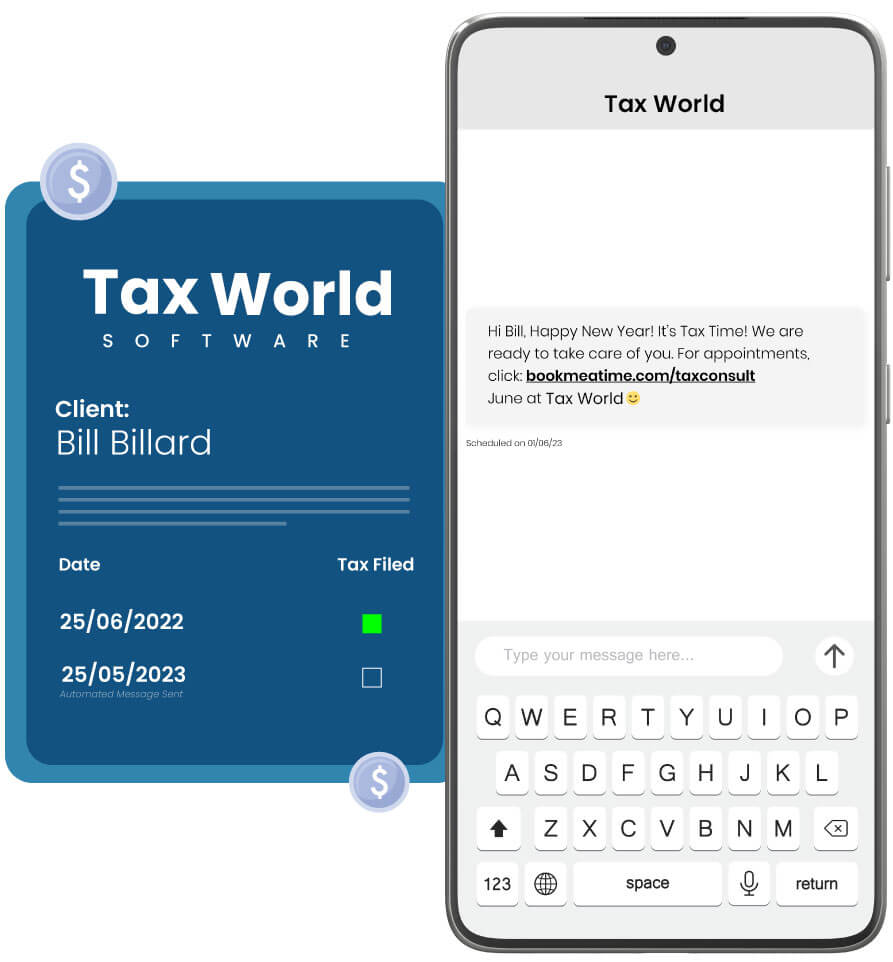

Waiting on clients to submit required tax documents is one of the biggest factors that slow down tax preparation.

Instead of waiting for an email response, a text asking for missing W-2s, receipts, or deduction records gets seen. Clients appreciate the quick nudge, and you avoid unnecessary delays in finalizing their tax returns.

Keep Clients Engaged After Tax Season

For many tax professionals, client communication drops off after April, which makes it harder to build long-term relationships and secure repeat business.

SMS offers a simple way to stay connected with clients throughout the year, reminding them of tax-saving opportunities, upcoming deadlines, and financial planning services.

Sending a mid-year check-in or tax planning reminder keeps your accounting services top of mind and encourages off-season consultations.

Clients who receive these updates are more likely to return for their next tax filing, which creates a stronger client base and a more predictable revenue stream.

Send Payment Reminders

Clients who owe taxes often forget their payment due dates. They don’t realize they’ve missed a deadline until they receive a notice from the IRS, at which point additional fees have already been added.

A simple SMS reminder before the due date helps clients stay on top of their tax obligations. Text messages are more immediate and prevent clients from overlooking an upcoming payment.

How to Choose the Right SMS Platform for Tax Professionals

Client communication during tax season can feel like an endless cycle of missed calls, ignored emails, and last-minute rushes. SMS can help you with these challenges, but only if implemented in a way that saves time instead of creating more work.

When looking for platforms, focus on features that will make a difference in your daily operations. Here are the following features to look for:

SMS Automation

Manual texting isn’t sustainable when dealing with dozens of clients. You must look for a platform that allows you to schedule messages and set up automated reminders for appointments, missing documents, payment deadlines, and tax filing updates.

If a client books a consultation, the system should automatically send a confirmation text, followed by a reminder a day before the appointment.

Similarly, when a tax return is filed, the system should trigger an SMS update without you having to do anything manually.

Two-Way Messaging

Some platforms only allow you to send messages but don’t let clients respond. This turns communication into a one-way broadcast instead of an actual conversation.

A high-quality SMS tool should allow two-way texting to make it easy for clients to ask questions, confirm appointments, or request additional information without calling or emailing.

If you send a text saying, “Reminder: Your tax appointment is tomorrow at 2 PM. Reply YES to confirm or call if you need to reschedule,” the client should be able to respond.

Secure Messaging & Compliance

Since you will deal with sensitive financial information, security should be a top priority when choosing an SMS platform. The system should use encryption to protect client data and comply with industry regulations, such as the Telephone Consumer Protection Act (TCPA) and data privacy laws.

A secure SMS platform should also give clients a way to opt in or out of text messages so they only receive the notifications they want.

You must avoid platforms that don’t offer SMS compliance and privacy protections, as they could expose you to compliance risks.

Integration With Tax Software

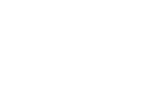

An SMS platform should work with the tools you already use rather than being a standalone system that requires extra effort to manage. The best solutions integrate with tax software, scheduling tools, and CRMs to automate texts based on client activity.

When a tax return is marked as filed in your tax software, the SMS system should automatically notify the client with a text like, “Your tax return has been filed. Expect your refund in 14-21 days.” This removes the need for manual follow-ups and keeps clients informed without extra effort on your end.

Bulk Messaging for Announcements

During tax season, you may need to send important updates to all clients at once, such as reminders about filing deadlines or office hour changes. A bulk-messaging feature lets you send a single message to multiple recipients without manually contacting each client.

In early March, you could send a mass text like, “The tax deadline is approaching! If you haven’t filed yet, schedule your appointment before April 15.”

Why Textellent Is the Best SMS Solution for Tax Professionals

While many SMS tools offer basic messaging, Textellent stands out as the best solution for tax professionals. It’s designed to automate client engagement, integrate with tax software, and handle compliance requirements.

Make It Easier for Clients to Work With You

Clients don’t always have time for phone calls and read lengthy emails.

Textellent allows you to add texting to your business phone line. Clients can reach out with questions, schedule appointments, and submit documents without needing to call.

To make inquiries even easier, you can add a “Text Us Now” button (a text-chat widget) to your website. Prospective clients can text from your site, which helps you convert more leads into paying customers.

Automate Client Retention

One of the easiest ways to grow your tax preparation business is to keep existing clients coming back. Instead of relying on emails or calls, Textellent uses data from your tax software to automatically send personalized reminders.

Clients who typically file in February will get an early-season reminder, while those who wait until April won’t be nudged too soon. Automated outreach eliminates the need for repeated follow-ups and ensures clients return on schedule.

Boost Reviews & Referrals

Happy clients are willing to leave reviews but rarely do unless prompted.

Textellent automates this process by sending a review request as soon as a tax return is completed. A simple text that includes a link to a review site along with a “5-star” image increases responses.

Referrals are also easier to manage. Instead of relying on word-of-mouth, you can send a promotional text blast offering a discount for referrals.

Many tax professionals see a 10-20% increase in referrals simply by making it easy for clients to share their trusted tax pro’s information.

Turn Advertising Into Action With Text-In Keywords

If you’re running ads on social media or direct mail, you need a way to engage potential clients. Textellent allows you to add a “Text-in” keyword to your advertising so prospects can text you to learn more.

Instead of hoping they’ll call later, prospects can text a keyword like “TAXHELP” and receive instant information about your services. It captures leads in real time and opens the door for follow-up conversations.

Reduce Missed Appointments & Last-Minute No-Shows

You can’t afford to have clients forget their appointments during a packed tax season schedule. Textellent’s automated scheduling system allows you to send reminders, confirm bookings, and even reschedule missed appointments.

If a client misses an appointment, they automatically receive a text with a rescheduling link that helps them fill open slots instead of losing revenue. Textellent’s customers report that 80% of their clients self-book, which reduces the need for manual scheduling and phone tagging.

Automate Client Follow-Ups & Paperwork Requests

Waiting on missing documents slows down tax preparation and increases last-minute stress. Instead of repeatedly calling or emailing clients, Textellent allows you to automate document requests.

Clients can even reply with a picture of their document, so there’s no need for unnecessary back-and-forth.

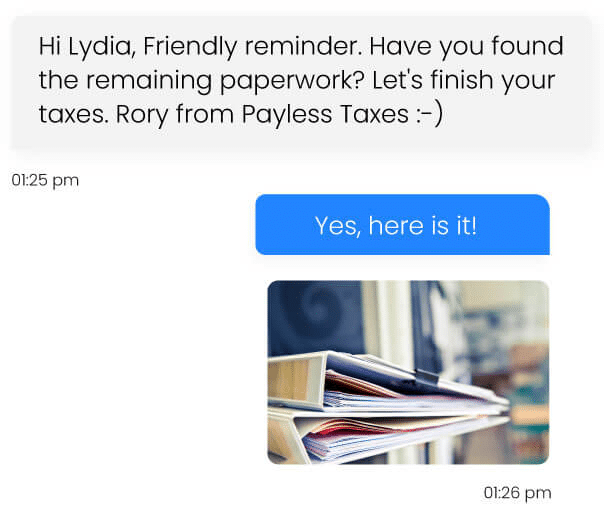

Keep Clients Engaged Year-Round

Tax season isn’t the only time you should be in contact with clients. Staying connected throughout the year keeps your services top-of-mind and strengthens relationships.

With Textellent’s automated text blasts, you can send quarterly tax payment reminders, personalized birthday messages, holiday greetings, or tax-saving tips to engage clients before the next tax season.

Text From Your Tax Software

Textellent’s most powerful feature is its direct integration with tax software.

Instead of switching between different tools, you can text clients directly from your tax preparation system. If you’re in the middle of a return and need clarification on a deduction, you can send a quick text without leaving your screen.

What You Need to Know Before Using SMS for Tax Season

To make SMS work for you, it needs to be strategic, well-timed, and integrated into your workflow. Otherwise, it becomes just another task rather than a tool that actually saves time.

Here’s what you need to know to successfully incorporate SMS during tax season.

Follow SMS Regulations

Since tax professionals deal with sensitive financial information, using SMS requires a clear understanding of compliance laws. Sending texts without consent or failing to protect client privacy could lead to legal issues.

Clients must be able to opt-out at any time, and sensitive information should never be included in text messages. Instead, SMS can be used as a gateway to secure platforms to direct clients to login portals where they can safely access their documents.

Set Clear Expectations With Clients

To make SMS a seamless part of your tax practice, let clients know what to expect. Before you start texting, communicate how and when they’ll receive messages from you.

For example, when onboarding a new client, you might say:

“We use text messaging for appointment reminders, document requests, and tax filing updates. You’ll never receive promotional messages, and you can opt-out anytime.”

This establishes trust and prevents clients from ignoring your texts, ensuring that your messages are received and acted upon.

Short and Clear Messages Work Best

Unlike emails, SMS messages aren’t meant to provide long explanations. The more direct your message, the higher the chance your client will act on it.

A message like “Your tax appointment is tomorrow at 3 PM. Reply YES to confirm.” is far more effective than a longer, overly detailed text. Clients should understand what’s required from them, with little room for confusion.

At the same time, don’t make messages feel robotic. Adding small personal touches, such as including the client’s name, helps maintain professionalism while keeping communication engaging and direct.

Right Timing Makes SMS More Effective

Text messages are read faster than emails, but that doesn’t mean you should send them at any time. The timing of your messages influences how clients respond.

Clients receiving a tax appointment reminder at 7 AM may ignore it until later and then forget. Similarly, a message about missing documents sent late at night may feel intrusive.

The best time to reach clients is during business hours, when they are more likely to act immediately.

Appointment reminders are sent the day before and again a few hours before, reducing no-shows. Tax filing deadlines require multiple reminders spaced out over weeks rather than last-minute notifications.

Integrate SMS With Your Tax Software

The best way to maximize SMS is by connecting it to your tax preparation software. Instead of manually tracking document submissions or sending individual updates, automated messages are triggered based on client actions.

If a return is filed, an automatic text notifies the client. If a required document is missing, a reminder is sent without you having to follow up manually.

Stress-Free Tax Season? Make It Happen With Textellent’s SMS Automation!

Tax season is one of the busiest times of the year. Keeping clients informed and making them respond can feel like an ongoing challenge, especially when schedules are tight.

Without a reliable way to reach them, this may lead to missed deadlines and added stress.

Clients expect fast, convenient interactions, and Textellent helps you deliver that while reducing the back-and-forth that slows down tax season.

A quick text reminder can prompt a client to submit missing paperwork or confirm an upcoming consultation. With Textellent’s integration into your tax software, messages are triggered so clients receive timely updates while allowing you to stay focused on tax preparation.

Experience a smarter, more simplified way to communicate. Sign up for a free trial or request a demo consultation today!

FAQs About Benefits of SMS During Tax Season

What are the three advantages of SMS?

SMS makes communication faster, easier, and more efficient during tax season.

First, it helps you get faster client responses since texts are read almost immediately, unlike emails or voicemails that can go ignored.

Second, it reduces no-shows and missed deadlines by providing timely reminders for appointments and document submissions.

Third, it speeds up communication by sending quick updates without long phone calls or back-and-forth emails.

What are the benefits of bulk SMS service?

Bulk SMS lets you send important updates to many clients at once and lessen the need for individual follow-ups.

It helps with deadline reminders, appointment confirmations, and general announcements, reducing. It’s also useful for staying connected with clients year-round by sending tax tips and estimated payment reminders.

What is the main advantage of using SMS marketing?

The biggest advantage of SMS marketing for tax professionals is that messages are delivered and read instantly.

It’s easy to engage with clients when reminding them to book an appointment, following up on tax documents, or sending promotions for early tax filing discounts.

When paired with no-code invoice automation, you can also automate payment collection to reduce manual processing and keep clients on track with their financial obligations.

What does SMS stand for on taxes?

SMS stands for Short Message Service, commonly known as text messaging. Tax professionals use it to send reminders, updates, and filing notifications to keep clients informed throughout tax season.

Some financial services may also use SMS to refer to secure messaging systems for encrypted communication.