How SMS Payments Cut Down on Missed and Delayed Payments

The rise of text message payment technology is primarily driven by how naturally it fits into the way people already communicate. Consumers are comfortable with texting, and this familiarity removes many of the barriers typically associated with digital transactions.

When paying becomes as simple as replying to a message, the overall payment experience is intuitive and far less intimidating than navigating a complex online portal.

Businesses are also implementing this approach because it simplifies the payment process from start to finish. Fewer steps mean fewer abandoned transactions, and customers are more likely to complete what they start.

In this article, we will break down the main types of SMS payments and the strategies that help you get the best results. You’ll also learn how SMS marketing for payment reminders eliminates the slow, repetitive steps that often hold your payment process back.

Types of SMS Payments

You have more than one way to use SMS payments to streamline collections, accelerate cash flow, and make the experience easier for your customers.

Choosing the right method helps support your operations while enabling customers to respond quickly without the hassles that come with phone calls or emailed invoices.

One-Time SMS Payments

If you bill customers occasionally or handle single services, one-time SMS payments give you a fast and simple way to get paid.

You send an automated text message, your customer opens the link, and the payment is completed through a secure payment link that supports their preferred payment method.

This cuts down on delays and helps you close out each job efficiently, especially when the customer pays right away without needing in-person transactions.

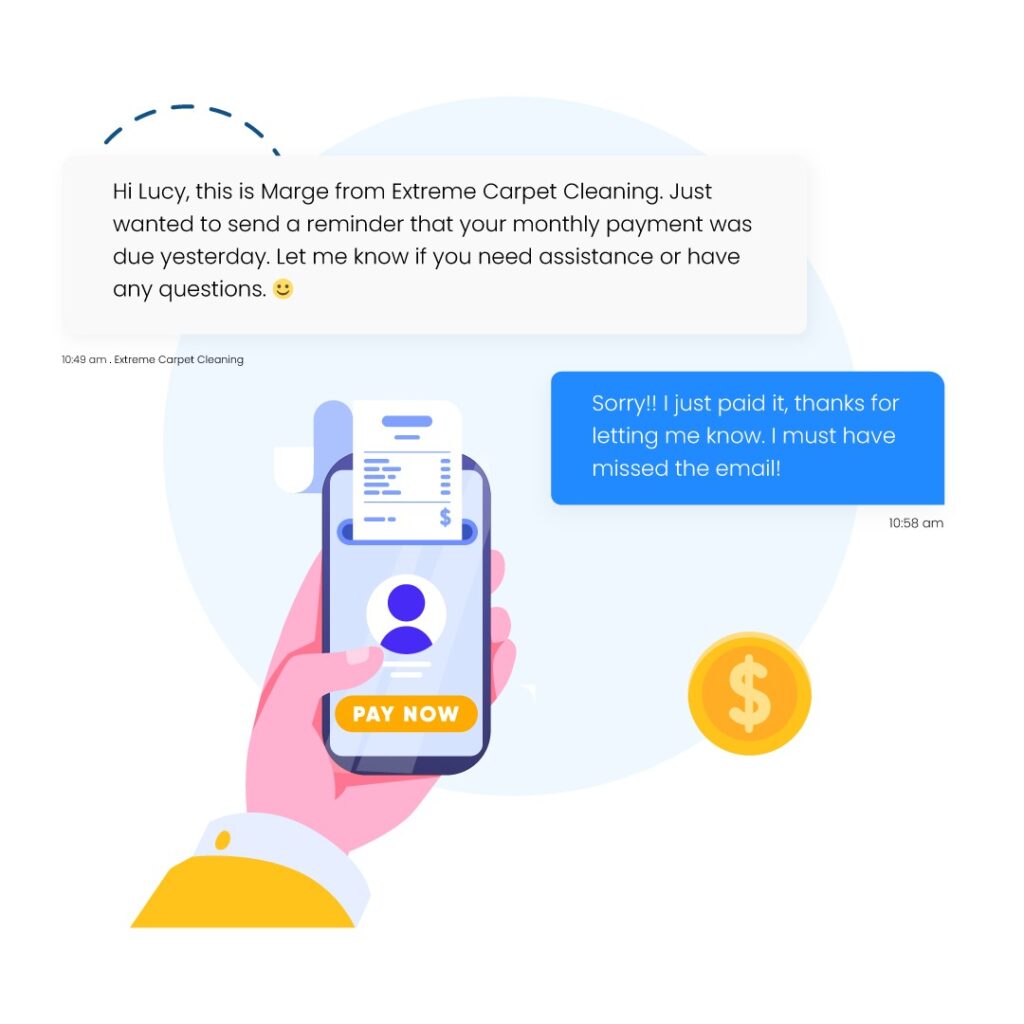

Recurring SMS Billing and Subscriptions

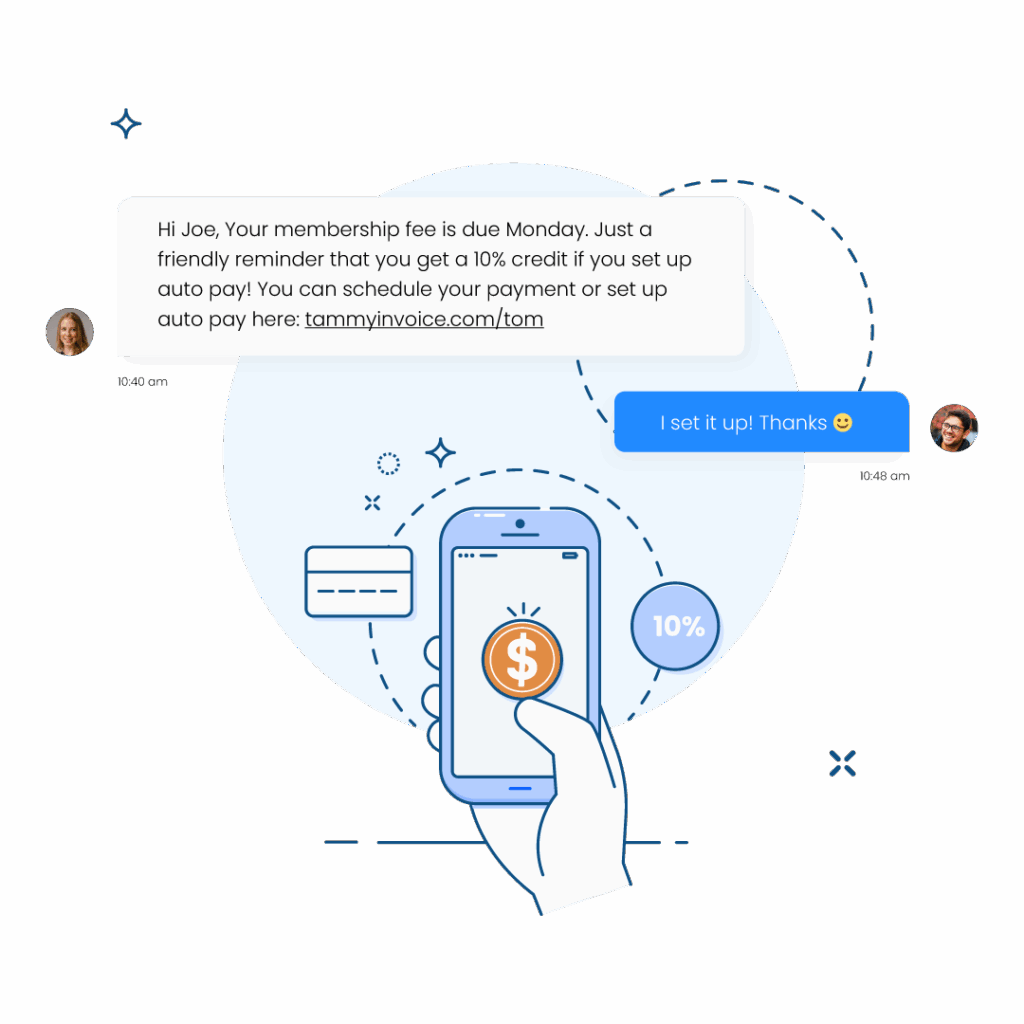

If your business runs on memberships, service agreements, or any form of ongoing program, recurring SMS billing helps you maintain revenue without adding unexpected monthly fees.

Your customer approves the recurring billing charge once, and the system handles the rest. This reduces the amount of manual follow-up you need to do and helps you avoid late or missed payments.

Pay-by-Text for Utilities, Rent, and Bills

If you handle routine billing for rent, utilities, or monthly services, pay-by-text keeps your customers informed and makes it easier for them to stay current. This can also reduce common security issues that happen with mailed statements or outdated systems.

People tend to respond more quickly through texts. Using a reliable text-to-pay system like Textellent reduces the time you spend chasing down payments.

Sign up for a free trial or request a demo consultation today!

SMS Invoicing for Service-Based Businesses

If your team provides in-person services, such as home repairs, consulting, medical care, or professional work, SMS invoicing lets you send the bill immediately after the job is done.

Your customer receives the message right away and can pay on the spot, which shortens the gap between completing the service and receiving the payment.

SMS Donations for Nonprofits

If you operate a nonprofit or charitable organization, SMS donations allow you to reach supporters at the right moment and make contributing easier for them.

People can respond, which increases participation and helps you collect funds during events, campaigns, or urgent situations.

Peer-to-Peer (P2P) Text Payments

If you host events, manage internal transactions, or need a flexible payment option for staff or customers, P2P text payments can be a practical solution.

They allow individuals to transfer money through text interaction, which is useful for reimbursements or any shared expenses.

Are SMS Payments Secure?

Security is one of the most important concerns when you decide how to collect payments, and modern SMS payment systems are built with strong protections in place.

The text message itself is only a delivery channel, powered by standard SMS technology. The actual payment is completed on a secure, encrypted webpage managed by a PCI-compliant payment processor.

A reliable SMS payment provider also uses fraud monitoring, identity verification, and ongoing compliance controls to keep your transactions protected.

This combination of safeguards gives your business the confidence to offer text-based payment options while maintaining a strong security posture.

If you want to strengthen this security, Textellent gives you a dependable foundation with built-in best practices, compliance support, and automated communication tools.

The platform’s approach helps you manage payment requests safely while also improving customer engagement, reminders, and customer follow-through.

Best Practices for Implementing SMS Payments

Once you feel confident in how the system protects sensitive information, the next step is making sure you use it in a way that delivers the best results. Using SMS payment messages strategically helps you guide customers smoothly from reminder to payment.

Here are a few proven practices you can use to create a smooth experience for your customers and strengthen the impact of every payment request you send.

Choose a Trusted SMS Payment Platform

The platform you choose should follow all required SMS compliance guidelines and protect customer information at every stage of the payment process.

This includes being able to send links via SMS that send customers to a verified payment processor that follows strict payment card industry standards, supports a secure payment gateway, and keeps card details safe.

The customer experience is just as important. A good platform will keep things simple, guiding people through each step of the payment flow.

It also helps to choose a tool that works well with the tools you already use. When your SMS system connects easily with your CRM, scheduling software, or billing tools, your team does not have to jump between different programs.

If you want a platform purpose-built for payment billing, Textellent is the best automated texting software you can use.

It offers two-way SMS for timely payment reminders, automated recurring campaigns, late fee alerts, and personalized segments based on account type or customer profile.

Sign up for a free trial or request a demo consultation with Textellent today!

Craft Actionable Payment Messages

The success of your SMS payments depends on how clear your messages are. You have to keep your wording simple and focused on the next step you want them to take.

Actionable messages help reduce late payments and make it easy for customers to respond quickly on any mobile device. Phrases like “Your payment is due today” or “Tap the link to complete your payment” give them an easy path forward.

When you text customers with a direct request and include the right payment info, they can move through the process with confidence and get everything paid faster.

Personalization can also make a noticeable difference. Using the customer’s name, referencing their appointment or service, or confirming the exact balance due can help your message look trustworthy.

Adding details like whether they are paying with a credit card, Apple Pay, digital wallets, or even a bank account can make the process feel secure.

Schedule Your Payment Requests

You want to reach customers at moments when they are most likely to see your message and take action. Midday and early evening work well because people are more settled into their routines and have a moment to respond.

When your SMS messages reach the right time, you increase the chances of immediate follow-through and reduce the number of reminders you need to send later.

SMS scheduling also helps to plan your requests around the natural billing cycle of your business. If you operate on monthly schedules, sending a reminder several days before the due date gives customers time to prepare and respond.

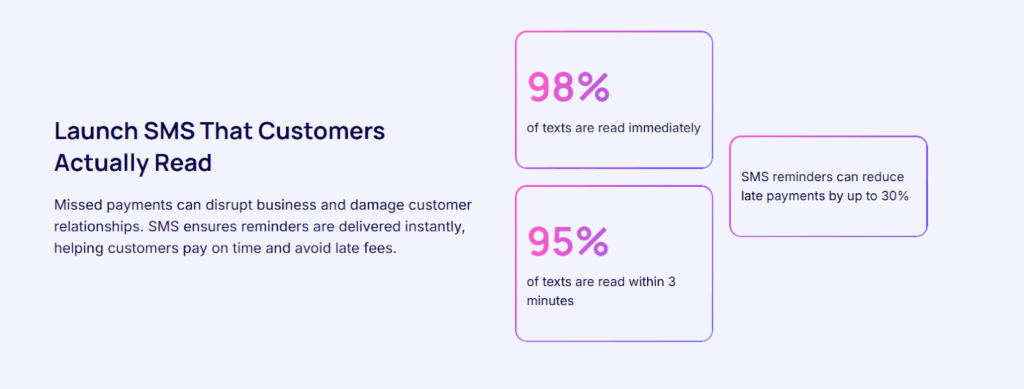

Use Automated SMS Reminders

Instead of manually chasing overdue invoices or trying to remember who needs a nudge, you can set up a reminder schedule once and let the system handle the rest. This keeps your outreach consistent.

A good approach is to build a simple reminder sequence around key milestones. For example, you can send a text reminder a few days before the due date, another on the due date itself, and a follow-up if the payment is still outstanding after a set number of days.

SMS automation also gives you more control over tone and targeting. You can customize messages by customer type, account status, or payment history so that people receive communication that matches their situation.

Boost Customer Convenience With Text-Based Payments—Try Textellent!

If you’re ready to make SMS payments a smoother and more reliable part of your business, Textellent gives you everything you need in one powerful platform.

This SMS payment solution is designed to help you reach customers instantly, simplify the payment process, and eliminate the delays that often come with traditional methods.

The experience is intuitive because your business sends a unique payment link that the customer clicks in their texting app, completing their payment with just a few clicks.

What sets Textellent apart is that it can automate the parts of the payment process that normally drain your time. You can send timely reminders, share balance updates, and deliver confirmation receipts.

The platform also lets you personalize messages based on customer profiles, payment status, or account type to increase response rates while keeping your communication professional.

With Textellent, paying through text becomes effortless for your customers and far more efficient for your team. Sign up for a free trial or request a demo consultation today!

FAQs About SMS Payments

What is an SMS payment?

An SMS mobile payment is a way for customers to pay through a text message sent to their mobile phone. The message includes a link that takes them to a secure page where they can review the amount due and complete the transaction.

Many businesses use this method to accept SMS payments and improve overall customer loyalty by offering a convenient experience.

How does paying by SMS work?

SMS payment works by sending a text message to the customer with a secure link. The customer opens the link, reviews the amount, and enters their payment details on a protected online form.

Once the payment is submitted, they receive a confirmation that everything has processed correctly. The text message acts as a payment notification, while the payment occurs on a secure webpage, often processed through a trusted credit card processor.

How to send payment through SMS?

You use an SMS payment platform or an integrated billing tool. You enter or upload the customer’s payment information and choose the message you want to send.

You may include the SMS payment link provided by your platform to reduce errors when the customer enters their details during checkout.

Many businesses automate these messages using accounting software so they go out at the right time without manual effort, helping support more on-time payments and fewer delays overall.

What is the difference between SMS and DMS payments?

In mobile billing, SMS payments refer to payments that start through a standard text message. This method avoids unpredictable transaction fees that come with carrier-billed options. It also allows customers to pay using familiar methods such as cards or Google Pay.

DMS payments, on the other hand, refer to carrier-based billing systems where charges can be added directly to the customer’s phone bill. This method requires two confirmation steps.

Customers may need to reply with a confirmation code or a specific word before the carrier authorizes the charge.