How to Use B2B SMS Marketing for Effective Lead Generation

Learn how to effectively carry out B2B SMS marketing and help your business communicate more efficiently through text…

Insurance agencies handle time-sensitive conversations every day. From policy questions to claim updates, text messaging delivers the speed and convenience your clients expect.

98% of texts get read within minutes. Replies arrive 10x faster than email. 75% of policyholders prefer texting for quick questions and updates.

Textellent gives insurance agencies a complete platform to manage client communication. Text from your agency number so clients recognize every message. Automate renewal reminders, policy updates, and claim follow-ups. Segment contacts by policy type, renewal date, or coverage needs. Sync conversations with your agency management system so your entire team stays informed.

of texts are read immediately

of consumers want to text businesses

of consumers said they have tried to text a business

Discover how insurance specific texting software can streamline client conversations while keeping every policy detail organized and accessible. Coordinate team visibility, centralized message history, and compliant opt in tools to support every interaction.

Maximize impact with insurance texting software by delivering timely reminders, tailored updates, and quick followups that feel personal at scale. Your agency stays agile as you connect with clients on the channel they actually use every day.

Learn how to effectively carry out B2B SMS marketing and help your business communicate more efficiently through text…

Explore business use cases for group text messaging and learn how to set it up for your communication…

Customers decide whether to engage with your brand in just a few seconds. That’s why your promotional texts…

The Textellent Messenger is a Chrome extension that lets your team text inside the apps you already use—no code, no tab-switching. View full conversation history, reuse approved templates and media, and keep replies organized in a shared inbox.

Textellent integrates with 800+ apps—CRMs, schedulers, forms, and payment platforms—so data flows in and texts go out at the perfect moment. Map fields once, tag contacts consistently, and keep systems in sync.

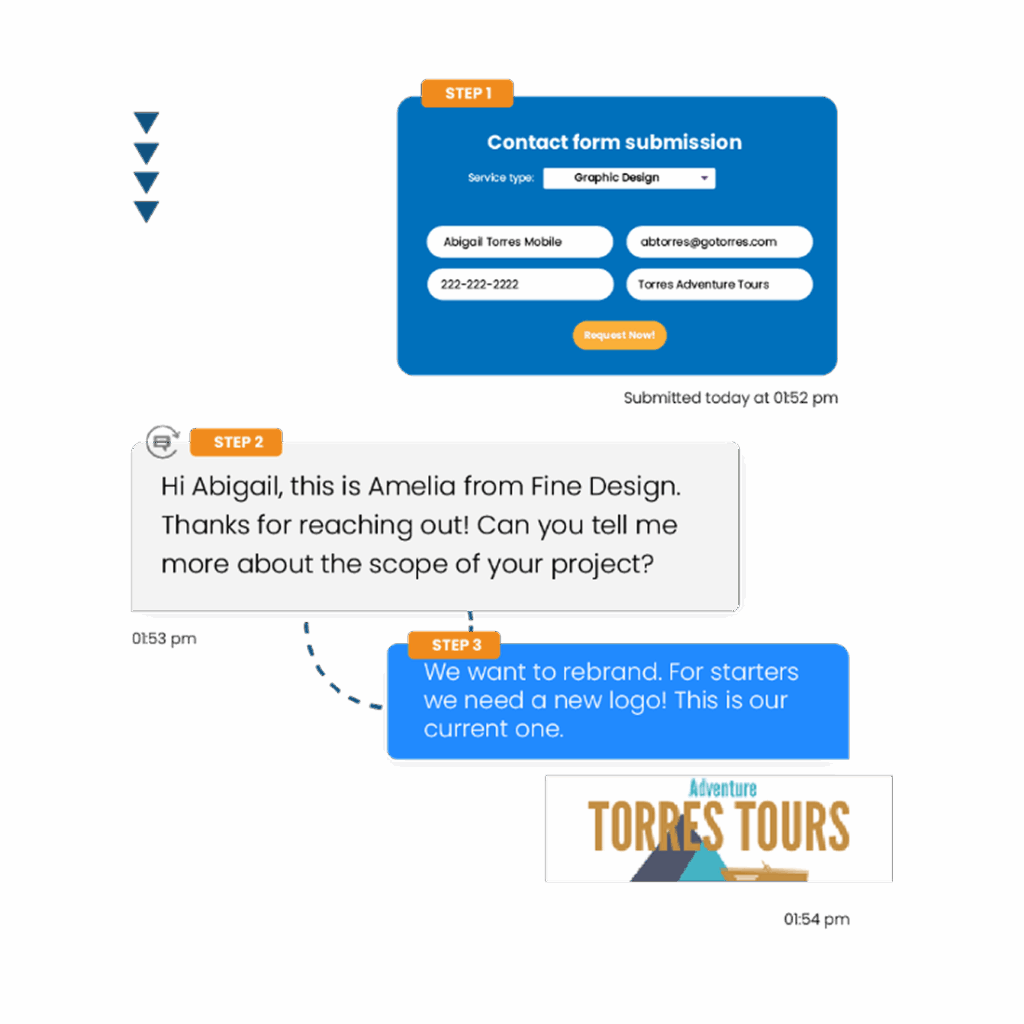

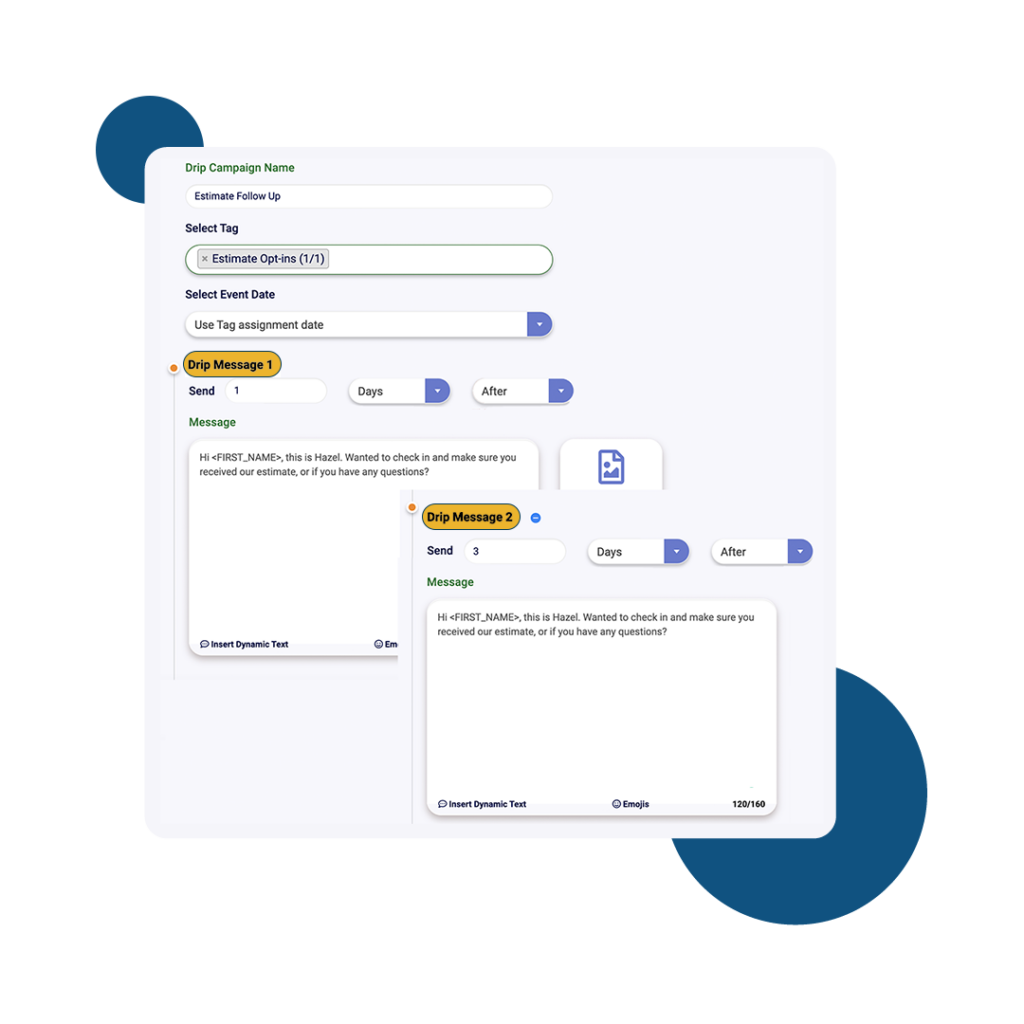

Turn common events into automatic SMS touchpoints: new leads, appointments, payments, status changes, and more. Build simple, rules-based flows that send the right text and follow-ups without manual work.

The Franchisor Module gives franchisors clear visibility across locations while empowering franchisees to execute consistent, on-brand texting that drives growth. Scale what works and spot where support is needed—fast.

Instantly polish your texts and translate them into different languages, making communication faster and more accessible.

Keep conversations moving on the go. The Textellent Mobile app brings your shared inbox to iOS & Android with real-time push notifications, quick-reply templates and media, conversation assignment, and full sync to your CRM—so nothing slips through when you’re away from your desk.